A version of this article first appeared in our free newsletter, to subscribe click here

I will start this article with an explanation of how the rankings are generated, then show the results of the rankings.

At the end I will give some advice based on my experience of working in the field for a number of years.

Here we go…

Preamble

The rankings are based on a weighted score system that I have developed to represent the best of my knowledge and experience regarding technical, certification and commercial (market) risks.

This method has my own bias baked into it (despite my best efforts) and I welcome any challenge or disagreement.

The aim of this effort is not to make people feel bad or harm any project. However, there are certain unavoidable realities regarding the certification process, the cost of developing and producing complex air vehicles and the unusual nature of the market regarding aircraft purchases and the flying public.

There are always winners and losers, and, in aerospace development there are no participation trophies. The failure of a program represents the loss of most, or all, of the value of the investment in that failed program.

The purpose of these rankings is not to identify those who will fail. I do not claim to be able to tell the future. The rankings are all relative so all the programs may fail or all of them may succeed. However, the rankings represent my best guess at the relative risk of failure of all of the programs considered.

You are welcome to address any comments to me directly at [email protected]

And a final word: I work with many of the eVTOL programs in this list. I have done paid work, pro bono and informal advising and technical work for many programs. It is a privilege to work with all of these programs. They are all doing their best to push the industry forward and develop new forms of transportation. I have done my best to avoid my relationships to any of these programs influencing my assessment.

The Assessment

The assessment is based on a modified set of weighted factors based on the white paper I authored in 2018: https://www.abbottaerospace.com/wpdm-package/aa-wp-2018-001/

I have updated the weighting and the method. If you are interested in the method please contact me for more information.

The assessment is broken down into the sub categories on the vertical flight society website. These are: Vectored Thrust, Lift + Cruise, Wingless Multicopter, Hoverbikes and Electric Rotorcraft.

These categories are all scored against the same metrics and so vehicles in these separate categories can be compared against each other.

A good number of the vehicles included in this assessment are pure technology demonstrators or early prototypes. For these immature designs, the outcome of my analysis and final placing is unkind and these projects are included for interest only.

The assessments are based on the state of current technology and the current regulations and interpretation. These rankings are not a criticism of the inherent value of the idea, it is my assessment of the likelihood of the design being brought to market and achieving commercial success in the current environment.

Categorical Comparative Assessment

All of the assessments are shown in a 2 dimensional space plotting a derived certification quotient (encompassing technical and regulatory risk – level of difficulty to develop and certify) and a similarly derived market quotient (encompassing all aspects of commercial risk – what is the likely market demand for the aircraft)

The 2D plots are all in the form shown below:

The top right corner of the graph represents a high score for both certification and and market quotients, the lower left hand corner of the graph represents a low score for both certification and market quotients

The comparative assessments within the separate categories are shown below:

Vectored Thrust

Lift + Cruise

Wingless Multicopter

Hover Bikes

Electric Rotorcraft

Summary and Combinations

The different types of VTOL aircraft when combined on the same graph give the following result:

And this is the same graph showing the projects with labels:

All projects considered and their scores are shown below in score order:

| Position | Score | Project |

| 1 | 0.662 | Transcend Air Vy 400 |

| 2 | 0.655 | Dufour aEro2 |

| 3 | 0.624 | Flexcraft |

| 4 | 0.612 | DeLorean Aerospace DR-7 |

| 5 | 0.560 | Samad Aerospace Starling Jet |

| 6 | 0.554 | Pegasus Universal Aerospace Vertical Business Jet |

| 7 | 0.481 | Cartivator SkyDrive |

| 8 | 0.466 | Ascendance Flight Technologies Atea |

| 9 | 0.457 | Lazzarini Hover Coupé |

| 10 | 0.454 | XTI Aircraft Trifan 600 |

| 11 | 0.407 | Alaka’i Technologies Skai |

| 12 | 0.388 | Gizio EJ420 ElectroJet |

| 13 | 0.386 | Vertical Aerospace (unmanned) |

| 14 | 0.378 | EHang 184 |

| 15 | 0.371 | Beta Technologies (prototype) |

| 16 | 0.368 | Lazzarini FD-One |

| 17 | 0.365 | Moller Skycar M200 |

| 18 | 0.359 | EHang 216 |

| 19 | 0.354 | Horus Hoverbike |

| 20 | 0.345 | EAC Whisper |

| 21 | 0.335 | Voyzon e-VOTO |

| 22 | 0.333 | AeroMobil 5.0 |

| 23 | 0.330 | Frogs 282 |

| 24 | 0.327 | Airbus Helicopters CityAirbus |

| 25 | 0.318 | Astro Elroy (“Passenger Drone”) |

| 26 | 0.314 | Imaginactive Ambular |

| 27 | 0.304 | Avioneo Robotics Avioneo 2345 |

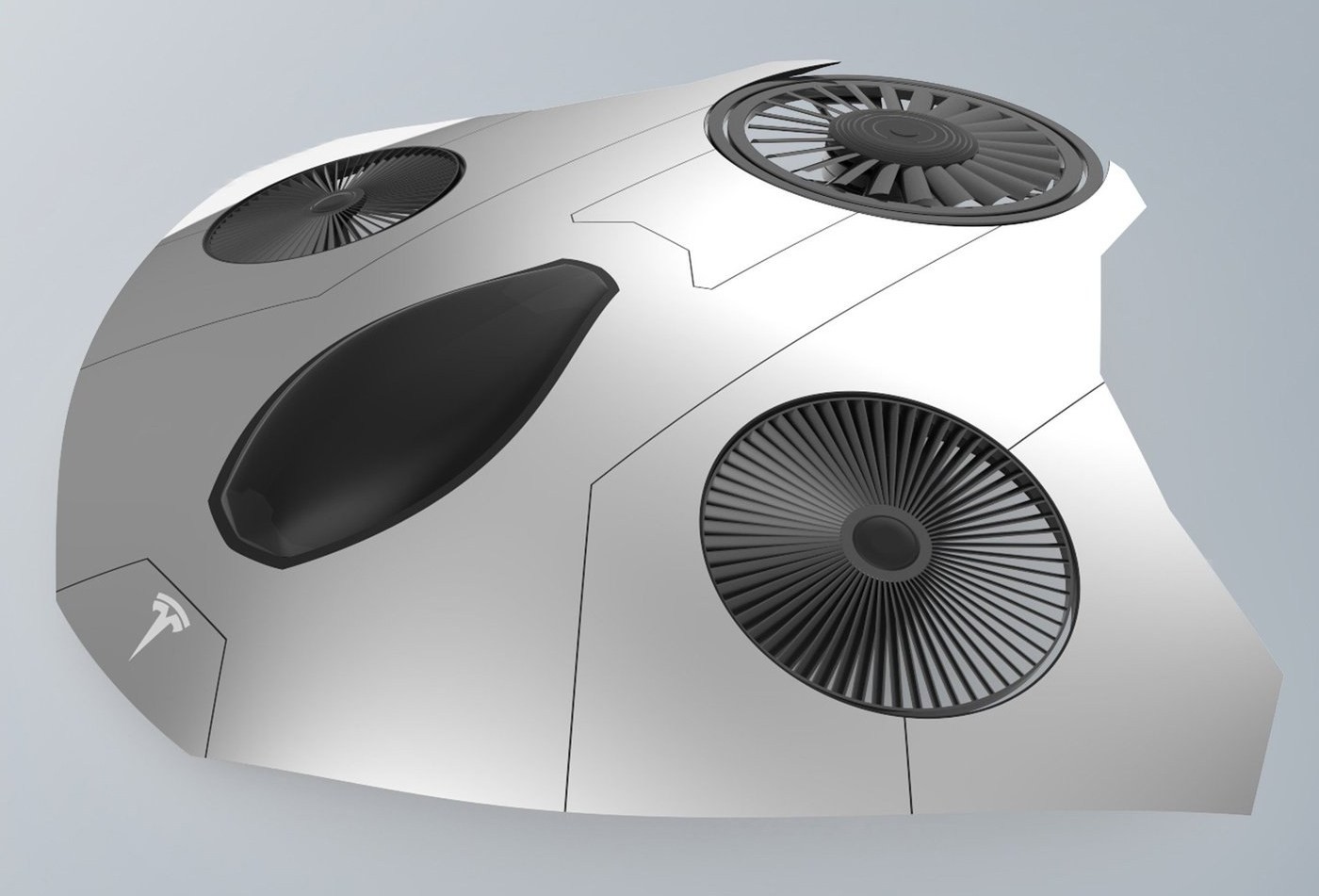

| 28 | 0.300 | Davies “Tesla Concept Model V” |

| 29 | 0.290 | Alauda Airspeeder |

| 30 | 0.290 | AirCar |

| 31 | 0.283 | Moog SureFly |

| 32 | 0.283 | Moog SureFly |

| 33 | 0.280 | Tier One Modified Robinson R44 |

| 34 | 0.267 | China Helicopter Research and Development Institute Electric Helicopter (CHRDI AVIC) |

| 35 | 0.266 | Kármán XK-1 |

| 36 | 0.263 | Airflight |

| 37 | 0.263 | Assen A1 |

| 38 | 0.261 | Zuri |

| 39 | 0.260 | Bay Zoltán Flike |

| 40 | 0.260 | SkyDrive SD-XX |

| 41 | 0.257 | ALI Technologies Xturismo |

| 42 | 0.244 | Piasecki PA-890 |

| 43 | 0.234 | HoverSurf Scorpion |

| 44 | 0.213 | Flyter PAC VTOL 720-200 |

| 45 | 0.210 | ALI Technologies Hover Bike |

| 46 | 0.210 | AirspaceX MOBi |

| 47 | 0.205 | Eco’Trip |

| 48 | 0.204 | Edea 22/1 Jay |

| 49 | 0.201 | Jetson Aero Speeder |

| 50 | 0.197 | Air Transportation Technology Catapult One – I, II |

| 51 | 0.195 | Ambular 2.0 |

| 52 | 0.187 | UAVOS SumoAir |

| 53 | 0.174 | Assen Aeronautics A2 Avenger |

| 54 | 0.174 | Wisk |

| 55 | 0.172 | Heitech Cruiser |

| 56 | 0.170 | Baykar Cezeri |

| 57 | 0.166 | Baaz Concept Design |

| 58 | 0.165 | SkyDrive SD-02 |

| 59 | 0.164 | Aerodyne Vector |

| 60 | 0.164 | Gizio DDRH/DDVL |

| 61 | 0.162 | Ray Research VTOL Aircraft |

| 62 | 0.162 | Removed |

| 63 | 0.159 | Leap Vantage – I |

| 64 | 0.156 | Pop.Up Next |

| 65 | 0.156 | Malloy Aeronautics Hoverbike |

| 66 | 0.147 | Heitech Air F1 |

| 67 | 0.141 | Archer |

| 68 | 0.136 | Davinci ZeroG |

| 69 | 0.134 | Zenith Altitude EOPA |

| 70 | 0.133 | Hemanth Sudhakaran AVEM |

| 71 | 0.132 | Aquinea ENAC Volta |

| 72 | 0.131 | PDRL AeroHans 2S |

| 73 | 0.131 | Kovacs Flike |

| 74 | 0.125 | Kronstadt Air Taxi |

| 75 | 0.124 | EVA Valkyr |

| 76 | 0.122 | Flyt Aerospace FlytCycle |

| 77 | 0.112 | Digi Robotics DroFire |

| 78 | 0.103 | Rolls-Royce EVTOL |

| 79 | 0.101 | Lazzarini Linux |

| 80 | 0.098 | Applied VTOL Concepts Epiphany™ FLYING CARpet |

| 81 | 0.093 | Deep Blue Aviation MX 18 Silhouette M |

| 82 | 0.092 | PAL-V International Liberty |

| 83 | 0.085 | Flexcraft Test Bench RPV |

| 84 | 0.084 | Lazzarini I.F.O. |

| 85 | 0.084 | Aston Martin Volante |

| 86 | 0.083 | Ambular 3.0 |

| 87 | 0.080 | Overair (Karem) Butterfly |

| 88 | 0.079 | Joby Aviation S4 |

| 89 | 0.078 | Gravity X Koncepto Millenya |

| 90 | 0.074 | Zeva Zero |

| 91 | 0.072 | Beta Technologies ALIA |

| 92 | 0.071 | Aurora Flight Sciences PAV |

| 93 | 0.070 | Neo Aeronautics Crimson S8 |

| 94 | 0.069 | Vinati F-Helix |

| 95 | 0.066 | EVA X01 |

| 96 | 0.065 | Hyundai S-A1 |

| 97 | 0.064 | OVER LLC |

| 98 | 0.062 | Skyworks Global eGyro |

| 99 | 0.061 | CAPS |

| 100 | 0.060 | Samad Aerospace HUMA |

| 101 | 0.058 | NFT ASKA |

| 102 | 0.057 | Embraer Pulse Concept |

| 103 | 0.052 | AirisOne |

| 104 | 0.050 | Robathan Range Rover eVTOL |

| 105 | 0.047 | CHRDI AVIC Sylan |

| 106 | 0.045 | AutoGyro eCavalon |

| 107 | 0.043 | MyDraco |

| 108 | 0.041 | Flutr Motors Flutr |

| 109 | 0.037 | Fraundorfer Aeronautics Tensor |

| 110 | 0.036 | DragonAir Airboard 1 & 2 – II |

| 111 | 0.030 | Varon V210 |

| 112 | 0.023 | Moscow Team AI Kamchatka |

| 113 | 0.021 | SKYLYS Aircraft AO |

| 114 | 0.020 | VerdeGo Aero PAT200 |

| 115 | 0.017 | SkyCab |

| 116 | 0.015 | Georgia Tech HummingBuzz – I |

| 117 | 0.012 | Micor Technologies Variable Geometry VTOL aircraft (VAGEV) |

| 118 | 0.007 | FanFlyer |

| 119 | 0.006 | Avianovations Hepard |

| 120 | 0.003 | Trek Aerospace FlyKart 2 – I, II |

| 121 | -0.004 | Grug Group Business eVTOL Jet |

| 122 | -0.006 | Uber Elevate eCRM-001 |

| 123 | -0.009 | Athena Aero |

| 124 | -0.012 | Aufeer Design Flying Taxi |

| 125 | -0.014 | Tecnalia |

| 126 | -0.015 | Moller Skycar M400 |

| 127 | -0.020 | Prime Design Consultancy Services Haricopter X1-B |

| 128 | -0.021 | Flyter PAC VTOL 420-120 |

| 129 | -0.023 | Embraer DreamMaker |

| 130 | -0.023 | ElectraFly ElectraFlyer |

| 131 | -0.026 | Manta Aircraft ANN1 |

| 132 | -0.026 | Heitech Magic Cloud |

| 133 | -0.034 | Leap Aeronautics |

| 134 | -0.043 | Colugo Systems |

| 135 | -0.044 | Macchina Volontis Flying Car |

| 136 | -0.051 | Terrafugia TF-X |

| 137 | -0.051 | PFV Personal Flying Vehicle #1 |

| 138 | -0.052 | PteroDynamics Transwing |

| 139 | -0.053 | Aliptera ADR-1 Dragon Rider |

| 140 | -0.054 | Napoleon Aero VTOL |

| 141 | -0.056 | Edea 22/2 Squid – II |

| 142 | -0.062 | COMAC eVTOL |

| 143 | -0.064 | CycloTech Compound Helicopter |

| 144 | -0.065 | Micor Technologies Advanced Individual VTOL Aircraft (AIVA) |

| 145 | -0.066 | KARI PAV |

| 146 | -0.067 | Swallow VTOL |

| 147 | -0.080 | aeroG Aviation aG-4 Liberty |

| 148 | -0.080 | Opener BlackFly V3 |

| 149 | -0.081 | Vickers WAVE eVTOL |

| 150 | -0.082 | Ryerson Helium – II, III |

| 151 | -0.087 | Esprit Aeronautics Lancer ePAV |

| 152 | -0.088 | Skyworks Vertijet |

| 153 | -0.096 | Carter Aviation Air Taxi/Jaunt |

| 154 | -0.097 | Detroit Flying Cars WD-1 |

| 155 | -0.098 | LIFT Hexa |

| 156 | -0.099 | Doroni Carbon One |

| 157 | -0.100 | rFlight rWing |

| 158 | -0.104 | Stuttgart Aerospace Apollo |

| 159 | -0.110 | Happy Takeoff Prism |

| 160 | -0.110 | Jetoptera J2000 |

| 161 | -0.122 | VRCO NeoXCraft |

| 162 | -0.124 | JAXA Hornisse 2B |

| 163 | -0.125 | Gizio CellCraft G150 |

| 164 | -0.127 | AutoFlightX V600 |

| 165 | -0.128 | Aeroxo ERA Aviabike – I, II |

| 166 | -0.130 | VOX Aircraft M400 |

| 167 | -0.132 | Ray Research Dart Flyer |

| 168 | -0.134 | Neva Aerospace AirQuadOne |

| 169 | -0.140 | Innowings Aerospace PKOK |

| 170 | -0.143 | Horizon AutoCopters Auto-Copter |

| 171 | -0.145 | Jaunt Air Mobility Journey |

| 172 | -0.153 | Kitty Hawk Heaviside |

| 173 | -0.161 | GroundAero Sport Utility Aircraft |

| 174 | -0.163 | Electric Jet Aircraft EJ-1S |

| 175 | -0.174 | VTOL Aviation Abhiyaan |

| 176 | -0.175 | Gizio CellCraft G450 |

| 177 | -0.182 | SkyBoom eVTOL Automobiles |

| 178 | -0.183 | Raven – III |

| 179 | -0.184 | B-Technology Beccarii |

| 180 | -0.184 | Collaborative Mini-Bee |

| 181 | -0.185 | Bell Nexus |

| 182 | -0.186 | VTOL Aviation India Abhigyaan NX |

| 183 | -0.197 | Lilium Jet |

| 184 | -0.203 | Industry Network Cocooon X-1 |

| 185 | -0.204 | Bell Nexus 6HX |

| 186 | -0.205 | EXA Air Car |

| 187 | -0.212 | Terrafugia TF-2 Tiltrotor |

| 188 | -0.216 | Autonomous Flight Y6S |

| 189 | -0.228 | KineticCo Aerospace and Advanced Technologies |

| 190 | -0.234 | CFC AirCAR |

| 191 | -0.235 | NEAE-GSI eVTOL-BUS |

| 192 | -0.235 | Prime Design Consultancy Services Haricopter X1-Q |

| 193 | -0.238 | Scoop Pegasus 1 – I |

| 194 | -0.239 | HoverSurf Formula |

| 195 | -0.242 | chAIR Multicopter |

| 196 | -0.243 | Hirobo Bit |

| 197 | -0.250 | Urban Aeronautics CityHawk |

| 198 | -0.251 | Paragon VTOL Aerospace T21 Raptor |

| 199 | -0.254 | Grug Group Ghost X V1 |

| 200 | -0.254 | Grug Group Ghost X V1 |

| 201 | -0.257 | Grug Group Ghost X V3 |

| 202 | -0.264 | AMSL Aero Vertiia |

| 203 | -0.271 | Aliptera APV-1 |

| 204 | -0.271 | GyroBike |

| 205 | -0.276 | A³ Vahana |

| 206 | -0.279 | Hoversurf Formula (No wing) |

| 207 | -0.282 | ACS Aviation |

| 208 | -0.299 | Aeronext Flying Gondola |

| 209 | -0.302 | Gizio EJ11 ElectroJet |

| 210 | -0.302 | CycloTech Passenger Demonstrator |

| 211 | -0.338 | Imaginactive Transvolution |

| 212 | -0.345 | Bartini Flying Car |

| 213 | -0.354 | Sharifzadeh Zero G eCruzer |

| 214 | -0.358 | Neoptera eOpter |

| 215 | -0.374 | Vertiia |

| 216 | -0.385 | HoverSurf Drone Taxi R-1 |

| 217 | -0.417 | Vision VTOL |

| 218 | -0.467 | Advanced System Engineering – FIPSI WX4 |

| 219 | -0.507 | Advanced System Engineering – FIPSI BX4 |

| 220 | -0.536 | HopFlyt Venturi |

The spread of scores were assessed to determine if the distribution included any anomalies that would indicate an error in the application of the scoring algorithm:

It appears that the application of the scoring method is free of obvious errors.

Summary of Results and ‘Awards’

The top scoring projects are unchanged from the initial assessment made in 2018. The top five eVTOL projects that exhibit the most favourable characteristics for certification and commercial success are:

| Position | Score | Project |

| 1 | 0.662 | Transcend Air Vy 400 |

| 2 | 0.655 | Dufour aEro2 |

| 3 | 0.624 | Flexcraft |

| 4 | 0.612 | DeLorean Aerospace DR-7 |

| 5 | 0.560 | Samad Aerospace Starling Jet |

Below are high scoring projects in some of the categories that I use for the assessment

Most Beautiful (In no particular order and according to my taste)

Davies “Tesla Concept Model V”

DeLorean Aerospace DR-7

Lazzarini Hover Coupé

ALI Technologies Xturismo

Most Unusual

Industry Network Cocoon X-1

Robathan Range Rover eVTOL

Volerian

Zeva Zero

Avianovations Hepard

Advice

This is where I sound off on what I think may help improve a project’s chances of getting to market and being successful once you get there.

This section is as populated with my personal bias as the rest of this article, these opinions are all my own.

- Gatekeepers: You have to get through the certification process. The award of a type certificate depends on a succession of findings of compliance for each paragraph of the regulations. Achieving a finding of compliance relies on the person awarding that finding. Develop your relationships with those individuals. Inspire confidence and over achieve with presenting good quality data in all circumstances. Management of the perception of risk is paramount.

- Money: The total cost of development is directly related to the time spent in development and certification. Keep your team small (minimize your $ per hour), expedite your certification program (minimize the total number of hours), reduce risks (minimize the chance of the number of hours increasing). Do not expand your team beyond the minimum size until you have a frozen detailed product specification and an approved certification plan. It is very easy to get into certification, very difficult to get out of it.

- Batteries: Assumptions of future battery energy density are unwise. Overestimation of present battery energy density is unwise. 250Kwh/Kg may be presently theoretically achievable. For the installed system it never is. Battery charge times and battery lifetimes have to be practically addressed. Thermal failure modes of Li-Po batteries have to be addressed and mitigated. Current installed battery/electrical drive systems are approximately 14 times less weight efficient than a turboprop system burning JetA.

- Hydrogen: Great energy density, lousy density. Expensive. No infrastructure. Hydrogen is a form of displaced NIMBY carbon dioxide generation. Your aircraft may be carbon neutral, the supply chain for your fuel is not.

- Mistakes: Everyone makes mistakes. It is very cost effective to learn from other people’s mistakes, it is very expensive to learn from your own.

In general, the air vehicle market has proven to be historically very conservative. It is very risk averse. In part this is because of the cost of insuring aircraft and in part because of the flying public’s general low threshold of perceived personal risk.

Just as you have to manage the perception of risk in the mind of the regulator you have to do the same for the insurance market and the minds of your future customers and users. We engineers find innovation very attractive and exciting. Other institutions and individuals do not feel the same way we do. There is some good data on the fear of flying and anxiety regarding flying here: Fear of Flying Statistics (2020 Data)

There is a trade off between promoting the new and exciting and reinforcing the dependable and reliable.

I fear that most eVTOL programs concentrate on the former and ignore the latter and this will harm them both in the certification process and with the customers.

[…] capital. For a very useful guide to the hundreds of AAM contenders, and the work behind them, see here. As the same site accurately notes, “When you see a program that combines electric propulsion […]