Commercial

The commercial risk is anchored on the MaaS (Mobility as a Service) business model that almost every eVTOL company relies on for commercial justification for their product.

The Market

Sales of the aircraft and the commercial success of the venture are related directly to the market for the service the aircraft creates. The market for the service is related to the relative cost of that service compared to the available alternatives.

To observe the obvious, the higher the cost of the mobility service provided by an eVTOL aircraft the less competitive it is, the lower the demand for that service will be and the lower the demand will be for the aircraft.

The number of aircraft you can sell, or rather the rate at which you can manufacture and sell them directly affects the cost of manufacture. The lower the rate of manufacture the higher the unit cost of manufacture. This is the classic ‘economy of scale’ phenomenon.

If demand for a product dictates that a company manufactures at a lower rate than planned, not only do they suffer a reduced revenue but they suffer a reduced margin.

This is a classic problem for aerospace OEM startups. They reach the market only to find that the demand is not what was projected. The worst case is that the cost of manufacture at the realized lower rate of manufacture is so high that a loss is made on each aircraft. Despite all the time and resources spent to get to market, and despite the excellence of the product, the company will fail after crossing the finish line. There are multiple examples of this outcome, the most notable are Sino Sweringen and Eclipse. Coincidentally, both programs spent a relatively very large amount of money to reach the general aviation market. In 2023 US dollars Sino Swearingen spent over $1.5BN and Eclipse over $2.5BN.

There are several limitations to the competitiveness of eVTOL MaaS. eVTOL aircraft are flying in the same environment as any other aircraft ‘on demand’ service and aircraft design has a limited effect on total aircraft operating economics compared to a conventional alternative. Some costs (insurance, landing fees, crew, etc.) will remain the same or will be higher than conventional alternatives.

The projection of eVTOL operating costs varies, but the approach defined by Robert Mann appears to be universally adopted:

“You can’t sell any of this stuff if you don’t make optimistic projections,” said Robert Mann… R.W. Mann & Company

Mobility Analyst, Asad Hussein writes: “Air taxi startup Lilium has claimed that the cost of a trip from Manhattan to JFK Airport could be $70, or approximately $4.40 per mile. Joby Aviation estimates the operating cost of its aircraft will be $3.80 per mile for a 25-mile trip, significantly below the cost of a $9-per-mile helicopter trip.”

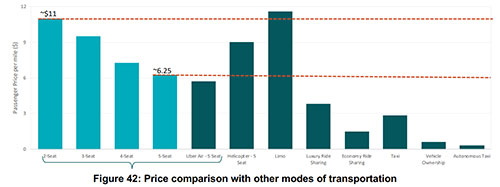

A study commissioned by NASA and carried out by Booz Allen Hamilton obtained the following results:

The results of their study show that an eVTOL aircraft only becomes competitive with a 5-passenger helicopter with (5 occupants) when it carries 4 passengers.

This reveals a small but potentially significant cost saving for operators. This saving is far less than the eVTOL operators claim, making truth of the statement by Robert Mann above.

The same Booz Allen Hamilton report pointed out that up to 60% of further cost savings were possible for eVTOL with autonomy (pilotless flight) and ‘technological improvements’. No timetable for the adoption of these measures was made.

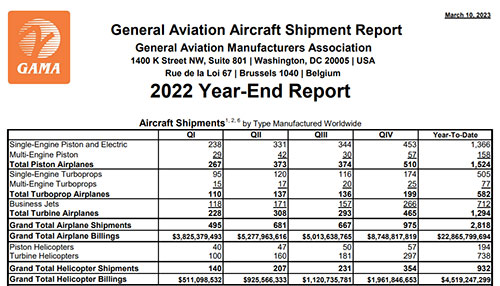

The criticality of projected economies of scale on eVTOL OEM business models cannot be overstated. Archer Aviation has made their investor deck publicly available and their volume production rate is mentioned on slide 44 as >5000 per year, although this is tempered on slide 47 as 2300 per year by 2030. To put this in context, GAMA (General Aviation Manufacturers Association) give global sale records of aircraft types. In 2022 a total of 932 helicopters were sold.

Archer’s business model requires that they sell nearly 2.5 times the entire global 2022 annual helicopter market in 2030.

The over optimistic projection of aircraft demand and production numbers creates a vast overestimation of production rates and reliance on unrealistically low production costs. The reality of higher aircraft operating costs, lower aircraft demand, lower production numbers and higher unit costs in manufacture will sharply contradict the optimistic business models. Company revenue will be reduced by at least one order of magnitude and the profit margin on each unit will disappear.

Reliability & MRO

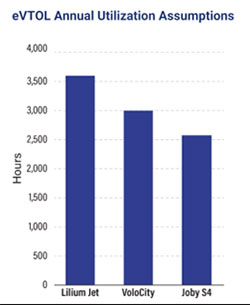

The operating economics of leading eVTOLs rely on aircraft being operated at a very high number of hours per year.

The value used by the FAA for systems safety analysis for large (part 25) commercial aviation is an average use of 3000 hours per year. It is not credible that aircraft operating over much shorter legs can exceed, equal or approach that value.

If eVTOL aircraft are to attempt to reach very high usage rates, the aircraft must have a very high dispatch readiness.

High dispatch readiness is related to both overall aircraft reliability and the ability to rectify, repair and replace whatever is needed to solve problems that arise and quickly return the aircraft to service.

Reliability

Aircraft electrical drive systems are often promoted as being more reliable than piston or turbine engine systems because they have fewer moving parts.

This is true (although turbine engines have surprisingly few moving parts) but has yet to be demonstrated.

A statement that is more likely to be true would be something like this. “When aircraft electrical powertrains are fully mature and all common service issues are understood and mitigations and resolutions fully developed there is a very good chance that they will prove more reliable than existing piston and turbine engines.”

The inherent theoretical reliability of a system is only one component of real-life reliability. When aircraft electrical powertrains are first used in service it would be rational to assume that they will be as reliable or less reliable than existing aircraft powertrains.

The potential increase in reliability can be realized over time with experience. We will only understand what this learning curve looks like after the fact.

The same can be said of the software control systems that these aircraft rely on to remain airborne. Development simulations and flight tests cover a subset of combined service conditions, vehicle states and pilot inputs when compared to what may happen in real life.

When these vehicles are first introduced into service the complexity and chaos of real operational conditions will be imposed on the control software. The limitations of the software will be revealed, airworthiness will be affected, and remedies will be required. It should be expected that Airworthiness Directives will be issued as a result and these vehicles will face restrictions and limitations or even grounding for some time.

These likely reliability risks apply just as much to any other component of new technology employed in these vehicles. Unique glass cockpits, control systems servo motors, sensors, et al.

MRO

The supply chain for LRUs (Line Replaceable Units) for conventional aircraft has consolidated over decades to the point where there is a commonality of suppliers and components between multiple aircraft manufacturers and aircraft models.

Commonly used aircraft vendor components are kept in stock at MRO centres all over the world and are available in minutes, replacement can occur, and the aircraft returned to service quickly.

This requirement to minimize time out of service typically drives new aircraft to consider the inclusion of as many existing vendor components for their aircraft as possible. There may be a small performance penalty to pay but it has a disproportionate effect on serviceability.

If there is an entirely new class of aircraft and each aircraft in that class employs a set of unique components that are unique only to that model of aircraft, the number of new components that may require replacement, repair or servicing will impose an excessive burden on the capabilities of an MRO organization.

If a set of unique components is required by only one aircraft type out of tens or hundreds of models of aircraft that an MRO centre serves, it is not economical to invest in the inventory and dedicate the warehouse space to keep these items in stock.

These aspects can delay the resolution of aircraft problems to the extent that the minutes required to get an aircraft back into service can extend to days or weeks.

Training the maintenance technicians on correct storage, handling, installation, and quality checking of the new components is a further challenge that must be addressed.

If multiple eVTOL aircraft are brought to market within a short time frame, each with a unique set of new LRUs, at best there will be a lag for MRO operations to catch up. At worst eVTOL may suffer in the longer term until their electrical system and drive components consolidate to the point where broad commonality makes local warehousing practical and enables timely MRO support. This may take decades.

Other Commercial Issues

Insurance

The insurability/cost of insurance for eVTOL aircraft is unknown. The risk of a new aircraft type based on new technology will be represented as a comparatively high cost of insurance.

Landing fees

The investment necessary to create the vertiport infrastructure for high volume eVTOL deployment will have to be recovered by levying landing fees for the users of the facilities. Landing fees are projected to be as high as $300 per passenger.

Residual Value

The appeal of eVTOL aircraft to fleet operators will be affected by the residual value of the product. This is another unknown. The residual value of electric cars may indicate that optimism is not warranted.

Market Acceptance and Customer Psychology

A high utilization rate presupposes a high market acceptance amongst potential users. Fear of flying is a problem that can affect a significant proportion of the population:

Between 33% and 40% of all people experience some form of anxiety when it comes to flying.

60% of sufferers experience generalized anxiety during the flight (and leading up to it) that they can easily manage on their own.

Between 2.5% and 5% of the population have crippling anxiety, a genuine fear of flying that is classified as a clinical phobia.

People report their first fear of flying “attack” at the age of 27 on average.

The introduction of a new, small type of aircraft will receive a greater than average phobic response and this will reduce the size of the available market for commercial operations.

Orders

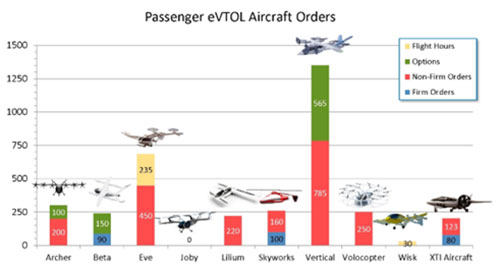

Orders with deposits are the greatest indication of demand from operators and confirmation of the commercial viability of the aircraft product. The proportion of overall eVTOL orders that are ‘firm’ is very low.

“While orders represent an important signal of demand, most of them are conditional, non-firm and not requiring any deposits, essentially allowing the operators to walk away from the deals.”

The lack of firm orders from eVTOL signals a lack of confidence from commercial operators.

Commercial Summary

The commercial case for eVTOL rests on very high utilization rates. It is incorrect to assume that eVTOL will achieve higher utilization rates than existing aircraft types in similar operations. Low initial reliability and low LRU availability will have a profound negative effect on utilization.

Commercial viability is also likely to be negatively affected by insurance costs, higher than projected landing fees and customer acceptance.

Unknown residual value will make fleet purchasers reluctant to invest in an asset of uncertain value.

A negative commercial outlook is confirmed by the lack of firm orders for eVTOLs.

Comment On This Post