I was privileged to attend the roll-out of the Boom Aero technology demonstrator on Tuesday night in Denver. To give complete disclosure, we had some input early in the program just as Blake was getting started and we did some very preliminary layouts for the production version. In no way can we claim credit for any of the real progress made on the program, we were just lucky to be involved in a small way early on. All credit is due to Blake and his current team.

Apologies for the quality of the picture for this article – I had my kindle fire in my pocket and had to make do with what I had to hand. I should have remembered my boy scout motto…..

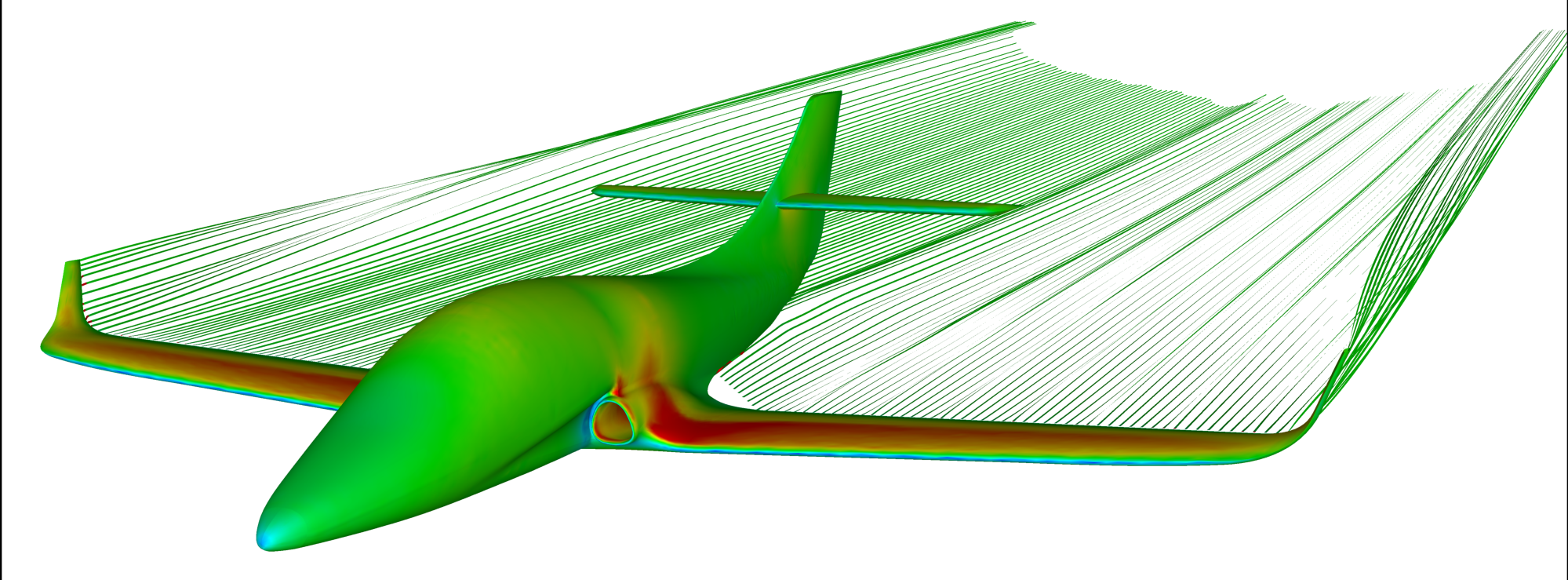

I really believe in the Boom operating model for the aircraft in service. I think they have that just right. I think the aircraft (the final production configuration) looks great and the technology demonstrator looks fabulous.

I have personally worked for aircraft startups since 2001 and Abbott Aerospace has done 95% of our business on multiple aircraft startup programs since 2008. We have seen the good and the bad and no project has a monopoly of either.

Harking back to previous posts on this subject (here and here), there are numerous financial pitfalls that the aircraft startup company faces. I believe that Boom has a market and their product is very well tuned to meet that market – they have defined their product and have a commercial argument better than the competition. Boom’s problem is how to get there without getting themselves and their investors into serious financial problems.

There are several relevant data points in terms of development costs – the Boeing 787 cost between $15Bn and $30Bn (depending on your source material) to develop and bring into volume production. The G650 took around $1Bn (it was probably more, but that is the published figure). It is worth noting that the G650 traded on a lot of the previous aircraft technology from Gulfstream while the 787 was a wholly new composite venture for Boeing.

However, both Boeing and Gulfstream had an established an organization, infrastructure and engineering and process/quality systems that they could use. They also had existing facilities and engineering teams not to mention global MRO and spares and repairs capability.

Setting up the organization from scratch, going supersonic, convincing the FAA (and overseas certification agencies) that you should be allowed to operate your aircraft, steering the company and the aircraft through the first few months or years of inevitable teething problems in service are all eye-wateringly expensive.

A startup company has to develop all of these aspects from the ground up and these are often the most underestimated aspects of the complete development. You must cover not only the engineering product but the means to manufacture it per the type certificate and keep your customers happy once the aircraft is in service.

The startup company has to develop (and pay for) all of these things. In the case of Boom considering their overall development cost, it would be better to purchase an existing suitable company. Lear, for example, are ripe for the picking and they would acquire floor space, an entire set of company engineering and build processes, an engineering team and a global spares and repairs operation. It would be much more economic to purchase an existing operation and adapt it to meet the needs of your program than it would be to invest in setting up all of these things.

Boom has a good chance of success. Their product has a market, they have some very good people involved and they have a self-confessed ‘zealot’ leading the charge. My fear is that they will not temper their blue-sky thinking with enough earthy pragmatism. But then again what do I know? In the end failure only shows us how to do it wrong. I sincerely hope Blake, his investors and his team are all successful in their aspirations and usher in a new golden age of both aircraft development and air travel. We could do with both.

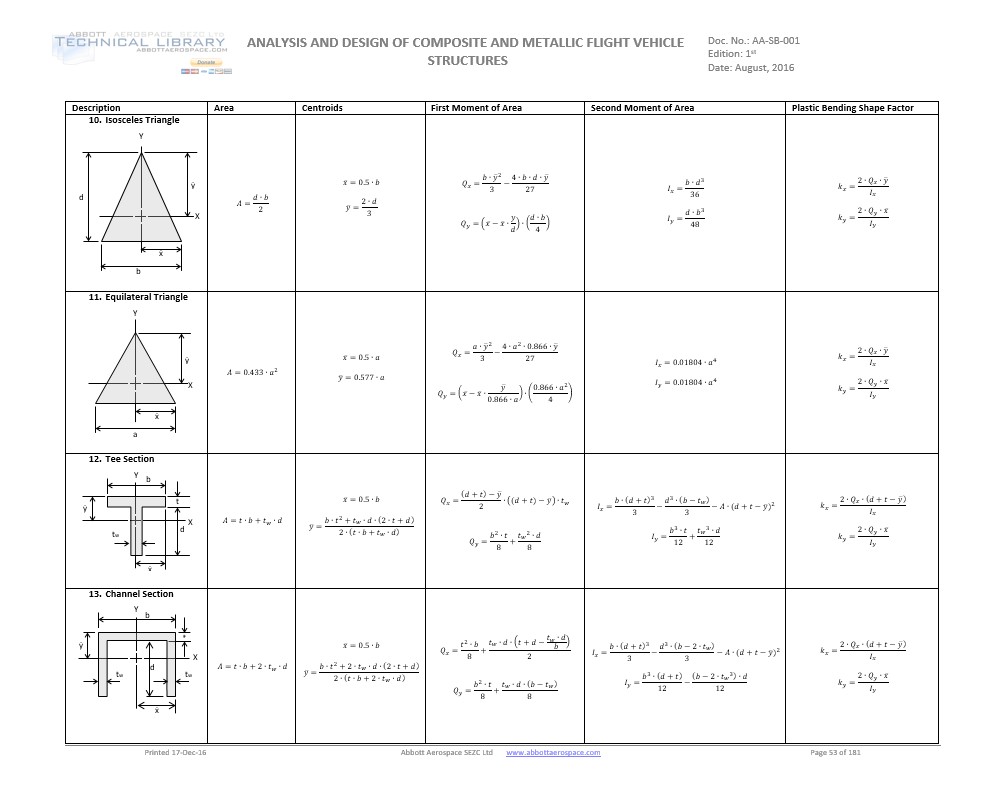

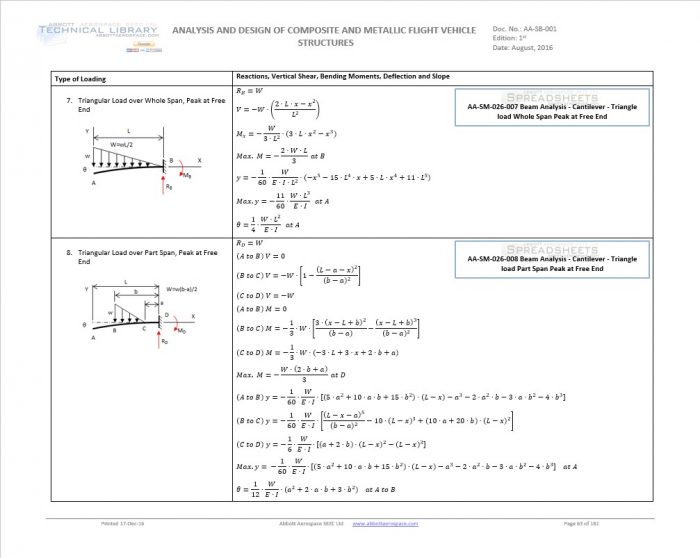

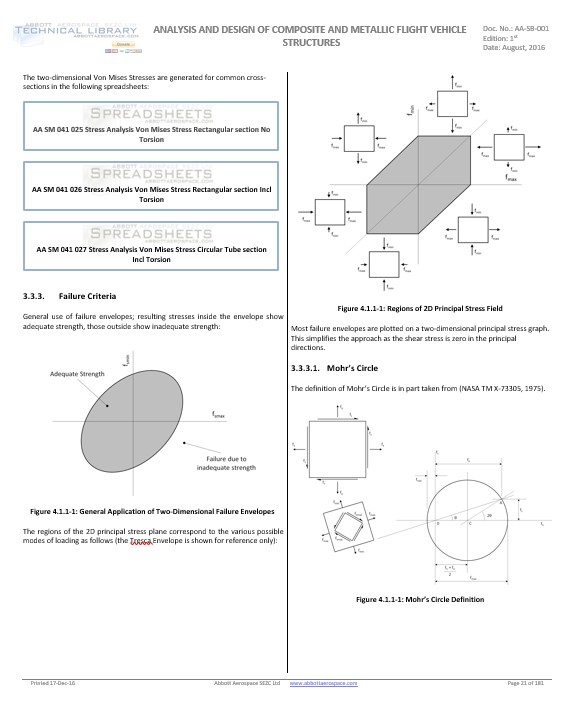

Stress Analysis: The section that I regretted most not including in the original edition was a section on basic stress tensors and material failure criteria. This section is aimed at isotropic materials (the equivalent plane strain failure criteria is already defined in the composite section of the first edition). This will come with links to spreadsheets for all of the methods.

Stress Analysis: The section that I regretted most not including in the original edition was a section on basic stress tensors and material failure criteria. This section is aimed at isotropic materials (the equivalent plane strain failure criteria is already defined in the composite section of the first edition). This will come with links to spreadsheets for all of the methods.

decided to go high and fast, therefore the Stratos 714 has a service ceiling of 41000ft and will cruise at 415KTAS. It also looks great – thanks to Gordon Robinson the chief aerodynamicist and scotch whiskey connoisseur (that’s a long story).

decided to go high and fast, therefore the Stratos 714 has a service ceiling of 41000ft and will cruise at 415KTAS. It also looks great – thanks to Gordon Robinson the chief aerodynamicist and scotch whiskey connoisseur (that’s a long story). There is no blueprint for success for VLJ singles getting to market. The upside to this is that the market is not crowded and there is clearly room for competition to the Cirrus jet. Stratos have a plan to get there. I am looking forward to a time when pilots and operators trade in their Cirrus SF-50s to upgrade to a Stratos.

There is no blueprint for success for VLJ singles getting to market. The upside to this is that the market is not crowded and there is clearly room for competition to the Cirrus jet. Stratos have a plan to get there. I am looking forward to a time when pilots and operators trade in their Cirrus SF-50s to upgrade to a Stratos.